Economic Insight: Strategies For Nigeria’s Development And Investment Opportunities

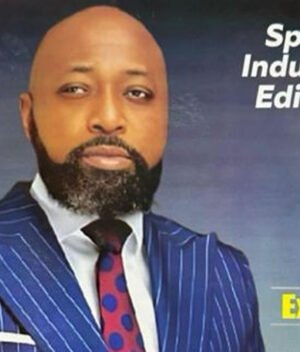

Dr. Ehizojie Ohiowele, FICA, Founder/CEO, Stateside Microfinance Bank Ltd, a member of the National Institute of Credit Administration, speaks on “ECONOMIC INSIGHT: STRATEGIES FOR NIGERIA’S DEVELOPMENT AND INVESTMENT OPPORTUNITIES”, in the National Institute of Credit Administration’s Credit Economy News.

- What would you say should be the way forward for Nigeria’s economic development?

The current situation in Nigeria presents challenges and opportunities for its economic development. Nigeria’s economy has long been dependent on oil exports, leaving it vulnerable to fluctuations in oil prices. Diversifying the economy by investing in sectors such as agriculture, manufacturing, technology, and services can reduce this dependency and create new sources of growth and employment. Also, improving infrastructure, including transportation networks, power supply, and digital connectivity, is essential for attracting investments, supporting businesses, and fostering economic development. The government should also support entrepreneurship, innovation, and small and medium-sized enterprises (SMEs) that will spur job creation, foster creativity, and drive economic diversification. Lastly, improving financial inclusion, expanding access to credit, and supporting microfinance initiatives can empower individuals, businesses, and communities to participate in the formal economy, access capital, and invest in productive activities. It is noteworthy to mention that enhancing financial literacy and developing inclusive financial services are key drivers of economic development.

- How can credit be used for economic and social transformation?

Credit plays a vital role in driving economic and social transformation globally and in Nigeria. By enabling individuals, businesses, and communities to access capital for investments, consumption, and entrepreneurship, credit can spur economic growth, alleviate poverty, and promote inclusive development. It empowers aspiring entrepreneurs and small business owners to start or expand their businesses. Credit supports farmers, agribusinesses, and cooperatives by providing funds for purchasing seeds, fertilizers, equipment, and irrigation systems. It helps to improve access to healthcare services, medical facilities, and social welfare programs, especially for underserved communities and vulnerable populations. Healthcare loans, insurance financing, and microcredit initiatives enhance healthcare delivery, address public health challenges, and promote social well-being.

Credit programs tailored for women and youth can empower these demographic groups to become financially independent, start businesses, and participate in economic activities. Lastly, Credit through microfinance institutions, community banks, and digital platforms can reach underserved populations, informal sector workers, and rural communities, providing them with access to financial services, credit, savings, and insurance products.

- What sector of Nigerian economy suffers development neglect?

One sector of the Nigerian economy that often suffers from development neglect is the healthcare sector. Despite being crucial for the well-being of the population and the overall economic development of the country, healthcare in Nigeria faces significant challenges that result in inadequate infrastructure, limited access to quality services, and disparities in healthcare delivery. Nigeria faces a shortage of healthcare professionals, including doctors, nurses, and other skilled healthcare workers. Many healthcare professionals are attracted to opportunities abroad or urban centers, leading to a lack of healthcare providers in rural areas and underserved communities.

Furthermore, the healthcare sector in Nigeria is often underfunded, with insufficient budget allocations for healthcare infrastructure, equipment, supplies, and personnel. This leads to a lack of modern medical facilities, shortages of essential medicines, inadequate staffing levels, and overall poor quality of care.

Many healthcare facilities in Nigeria also lack basic infrastructure such as electricity, water supply, sanitation, and medical equipment. This hinders the delivery of quality healthcare services and contributes to a negative patient experience. By prioritizing the healthcare sector and addressing the underlying causes of neglect, Nigeria can improve the health and well-being of its population, enhance healthcare delivery, and contribute to overall economic and social development.

- Give your honest advice to the present federal government.

My advice to the present government would be to actively pursue economic diversification beyond oil and gas to build a more resilient and sustainable economy. Supporting sectors such as agriculture, manufacturing, technology, and services can create jobs, reduce poverty, and stimulate growth. There should also be a focus on infrastructure development, including roads, power, water supply, and telecommunications, to support economic growth, attract investments, and improve the quality of life for citizens. Investment in healthcare and education sectors to improve access, quality, and outcomes is another crucial area. Addressing the neglect in these areas can have a long-term positive impact on the well-being and prosperity of the Nigerian people.

Finally, addressing the security challenges and strengthening governmental institutions, upholding the rule of law, & promoting good governance to ensure fairness, justice, and equality for all Nigerians is compulsory and will enhance political stability and public trust.

- As a Fellow of NICA, what advice and support do you have for the Institute and its members?

As a Fellow of the Nigeria Institute of Credit Administration, I have a valuable role to play in advising and supporting the institute and its members. I intend to leverage my experience and expertise to provide mentorship and guidance to younger members of the institute, share insights, best practices, and lessons learned to help them succeed in their careers in credit administration. I will contribute articles, whitepapers, and research papers on credit administration and related topics to enhance the institute’s thought leadership position. Lastly, I will advocate for the interests of the institute and its members within the broader financial and business community by networking with industry stakeholders, policymakers, and regulatory bodies to advance the goals of the institute and promote the importance of credit administration in Nigeria.

- What sector of Nigerian economy do you want foreign investors and business partners to come in?

The choice of sector for foreign investors and business partners in Nigeria would typically align with their investment objectives, expertise, risk tolerance, and commitment to sustainable business practices.

Foreign investors and business partners looking to invest in Nigeria would have different sectors to consider as the Nigerian economy is robust with prospects for good returns on investment.

Agriculture is a fundamental sector of the Nigerian economy, with abundant arable land and a large labor force. Opportunities exist for investment in commercial farming, agribusiness, food processing, and agricultural technology to improve productivity and promote food security. Also, as Nigeria aims to diversify its energy sources and reduce dependence on fossil fuels, there are opportunities for investment in renewable energy projects such as solar, wind, and hydroelectric power. Lastly, Nigeria is a major oil producer, with vast reserves of crude oil and natural gas. The oil and gas sector remains a critical part of the Nigerian economy, and it offers opportunities for investment in exploration, production, refining, and distribution activities.